do nonprofits pay taxes on interest income

Do 501c3 pay taxes on donations. A church owes income taxes if it has income that is 1 from a trade or business 2 regularly conducted that is 3 not substantially related to their exempt purpose.

Nonprofits Fail Here S Seven Reasons Why Tracy Ebarb

Most nonprofits fall into the 501c3 category and this is the category that offers the most tax benefits.

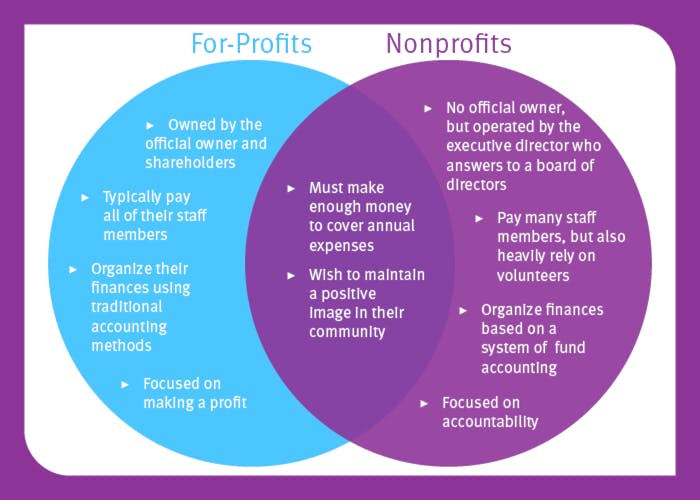

. Yes nonprofits must pay federal and state payroll taxes. The portion of the income or gain thats debt-financed is generally subject to UBIT. In the US dividends are considered income for tax purposes.

Even then tax-exempt non-profit organizations which do not further qualify as a public charity still have to pay a federal income tax of either 1 or 2 of their investment gains. Just because you have a tax-exempt status it does not mean that youre well tax exempt. Or maybe you received a payment for indoor tanning services you providedyoud have to pay taxes on this income quarterly.

While it is true that under most circumstances tax-exempt organizations are not subject to a corporate level income tax as their taxable entity counterparts are required to. Your recognition as a 501 c 3 organization exempts you from federal income tax. In other words nonprofits have to pay UBIT if income incurred is not related to the charitable mission of the organization.

However this corporate status does not. Nonprofits typically dont have to pay federal income taxes. Did you know that sometimes nonprofits must pay income tax.

For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses are responsible for. Ad Answer Simple Questions About Your Life And We Do The Rest. However they are usually taxed differently than regular income.

Nonprofits are organizations that operate for the collective public and private interest without aiming to generate profits for the founders. Whether a nonprofit corporations interest is subject to income tax depends the incomes source. Recently the IRS has increased its scrutiny of nonprofits UBTI.

General Rule By and large interest is not subject to income tax for nonprofit corporations. There are other types of exempt nonprofits such as 501c4 social welfare organizations. Note that each one of these factors requires.

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. Unlike businesses nonprofits organizations. In most cases they wont owe income taxes at the.

Most nonprofits fall into this category and enjoy numerous tax benefits. You and your nonprofit employer share this and the. One of the purposes of the.

First and foremost they arent required to pay federal income taxes. Although 501 c 3 organizations dont pay tax the IRS requires them to report revenue and expenses just like a company that is subject to tax. You must pay Social Security tax on your earnings of 10828 or more if youre an employee of a nonprofit organization.

Nonprofits that qualify for 501c3. Nonprofits are exempt from federal income taxes based on IRS subsection 501c. A married couple for example does not pay any taxes on.

This is because nonprofits are typically organizations that exist for public and private interest with no interest in making a. But nonprofits still have to pay. In short the answer is both yes and no.

How Current Us Tax Policy Impacts Donors And Nonprofits

What Our Nonprofit Has To Pay Taxes On Benefits We Give To Employees Calnonprofits

The 2022 Tax Season Has Started Tips To Help You File An Accurate Return Internal Revenue Service

How To Start A Nonprofit In 5 Steps 2022 Guide Forbes Advisor

/200270955-001-5bfc2b8bc9e77c00517fd20f.jpg)

Do Nonprofit Organizations Pay Taxes

Difference Between Nonprofit And Tax Exempt Mission Counsel

What Nonprofits Need To Know About Sales Tax Taxjar

How Do Nonprofits Make Money Making Nonprofits Profitable Jitasa Group

Sales And Use Tax Exemptions For Nonprofits

A Guide To Nonprofit Accounting For Non Accountants Bench Accounting

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Should Nonprofits Seek Profits

What Are Tax Exempt Organizations Asu Lodestar Center For Philanthropy And Nonprofit Innovation

Beginner S Guide To Nonprofit Accounting Netsuite

When Does Your Nonprofit Owe Ubit On Investment Income Marks Paneth

State Of Nj Department Of The Treasury Division Of Taxation Nonprofit Organizations

How The Irs Defines Charitable Purpose Foundation Group

The Nonprofit Sector In Brief 2019 National Center For Charitable Statistics

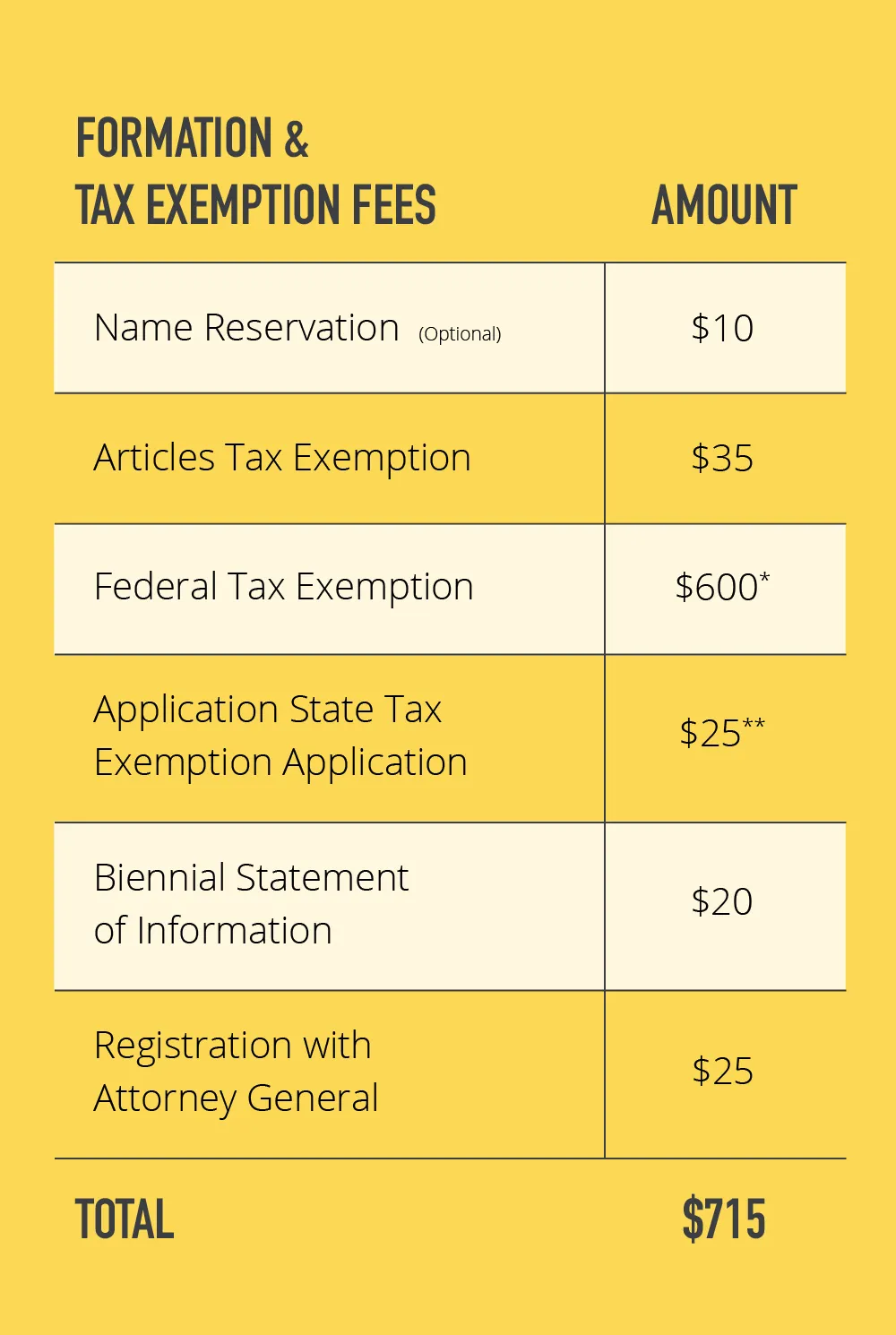

Starting A New Nonprofit Organization Center For Nonprofit Management